Introduction: Financial projections are crucial for businesses of all sizes and types, serving as a roadmap for future financial performance and guiding strategic decision-making. Whether you’re a startup seeking funding, an established company planning for growth, or an entrepreneur evaluating new opportunities, creating accurate and realistic financial projections is essential for success. In this comprehensive guide, we will walk through the process of creating financial projections, from gathering data and assumptions to building detailed forecasts and analyzing results.

Section 1: Understanding Financial Projections

1.1 Importance of Financial Projections: Financial projections provide insights into a company’s future financial performance, cash flow, and profitability. They serve as a tool for planning, budgeting, and forecasting, helping businesses set realistic goals, allocate resources effectively, and measure progress over time. Financial projections are also essential for attracting investors, securing financing, and demonstrating the viability and potential of a business venture.

1.2 Types of Financial Projections: There are several types of financial projections that businesses may need to create, including:

- Income statement projections: Forecasting revenues, expenses, and net income over a specific period, typically monthly, quarterly, or annually.

- Cash flow projections: Estimating cash inflows and outflows to determine the company’s liquidity and ability to meet financial obligations.

- Balance sheet projections: Projecting assets, liabilities, and equity at a specific point in time, providing a snapshot of the company’s financial position.

- Break-even analysis: Calculating the level of sales needed to cover fixed and variable costs and reach the break-even point.

1.3 Uses of Financial Projections: Financial projections serve various purposes, including:

- Strategic planning: Guiding long-term strategic decisions and business planning initiatives based on anticipated financial outcomes.

- Investor presentations: Providing potential investors with insights into the company’s growth potential, profitability, and return on investment.

- Budgeting and resource allocation: Allocating financial resources effectively to support operational activities, projects, and initiatives.

- Performance monitoring: Tracking actual financial results against projected targets to identify variances and take corrective actions as needed.

Section 2: Steps to Create Financial Projections

2.1 Gather Data and Assumptions: Start by collecting relevant financial data, historical performance metrics, and market research to inform your projections. Gather information on revenues, expenses, assets, liabilities, market trends, industry benchmarks, and other factors that may impact your financial projections. Additionally, document key assumptions, such as sales growth rates, pricing strategies, cost trends, and market penetration estimates.

2.2 Choose a Financial Projection Method: Select an appropriate method for creating financial projections based on your business model, industry dynamics, and specific requirements. Common methods include:

- Top-down approach: Starting with macroeconomic factors and industry trends to estimate overall market demand and then deriving company-specific projections based on market share and competitive positioning.

- Bottom-up approach: Building projections from the ground up by estimating sales volumes, pricing, and costs for individual products or services and aggregating them to create overall financial forecasts.

- Hybrid approach: Combining elements of both top-down and bottom-up approaches to leverage market data while incorporating company-specific factors and insights.

2.3 Forecast Revenue Streams: Estimate future revenues by analyzing historical sales data, market trends, customer demand, and competitive dynamics. Consider factors such as pricing strategies, sales channels, customer acquisition, and product/service mix when projecting sales volumes and revenues. Use multiple scenarios and sensitivity analyses to account for uncertainties and variations in market conditions.

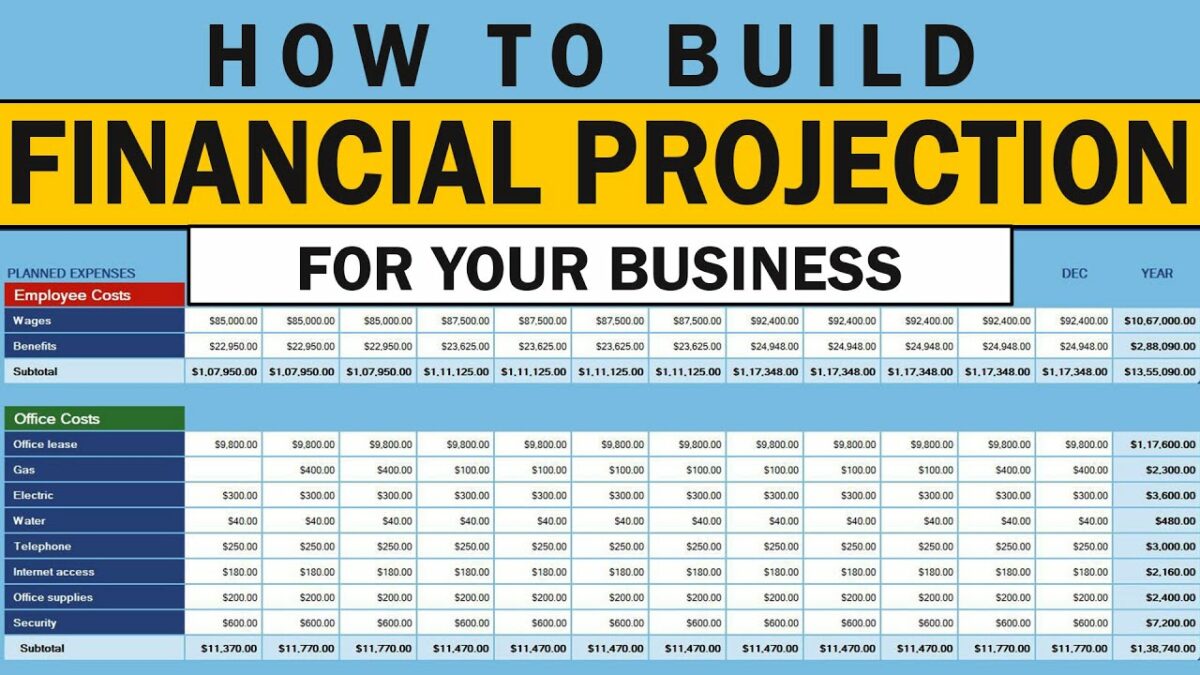

2.4 Project Expenses and Costs: Forecast operating expenses, variable costs, and fixed costs based on historical data, industry benchmarks, and future business plans. Consider factors such as employee salaries, marketing expenses, overhead costs, raw materials, and production costs when estimating expenses. Use cost drivers, cost allocation methods, and cost-saving initiatives to optimize expense projections and improve profitability.

2.5 Estimate Cash Flow and Working Capital: Develop cash flow projections by analyzing cash inflows and outflows from operating activities, investing activities, and financing activities. Consider factors such as accounts receivable, accounts payable, inventory levels, capital expenditures, debt repayments, and equity financing when projecting cash flow. Monitor working capital ratios, liquidity metrics, and cash conversion cycles to ensure adequate cash reserves and financial stability.

2.6 Build Balance Sheet Projections: Create balance sheet projections by forecasting assets, liabilities, and equity based on projected revenues, expenses, cash flows, and financing activities. Estimate changes in asset values, debt obligations, equity investments, and retained earnings over the projection period. Ensure that balance sheet projections remain consistent with income statement forecasts and cash flow projections to maintain financial integrity and accuracy.

Section 3: Financial Projection Best Practices

3.1 Be Realistic and Conservative: Avoid overoptimistic projections and base assumptions on credible data, market research, and historical trends. Err on the side of caution when estimating revenues, expenses, and cash flows to account for potential risks, uncertainties, and external factors that may impact financial performance.

3.2 Use Multiple Scenarios: Develop multiple scenarios and sensitivity analyses to assess the impact of different assumptions, variables, and scenarios on financial projections. Consider best-case, worst-case, and base-case scenarios to evaluate potential outcomes and develop contingency plans for managing risks and uncertainties.

3.3 Validate Assumptions: Validate key assumptions and inputs used in financial projections through research, analysis, expert opinions, and peer reviews. Verify the accuracy and reliability of data sources, market data, industry benchmarks, and economic indicators to ensure the credibility and integrity of projections.

3.4 Update Projections Regularly: Review and update financial projections regularly to reflect changes in market conditions, business strategies, and performance trends. Monitor actual financial results against projected targets, identify variances, and adjust projections as needed to align with evolving business dynamics and objectives.

3.5 Seek Professional Advice: Consult with financial advisors, accountants, and industry experts to validate assumptions, review projections, and provide valuable insights and guidance. Leverage external expertise and perspectives to enhance the accuracy, credibility, and reliability of financial projections and improve decision-making outcomes.

Section 4: Tools and Resources for Creating Financial Projections

4.1 Financial Modeling Software: Utilize financial modeling software and tools to streamline the process of creating, analyzing, and visualizing financial projections. Choose from a wide range of specialized software solutions, spreadsheet templates, and online platforms designed for financial modeling, scenario analysis, and sensitivity testing.

4.2 Accounting and ERP Systems: Leverage accounting software and enterprise resource planning (ERP) systems to access real-time financial data, automate data inputs, and integrate financial projections with accounting processes. Integrate financial projection models with existing systems to facilitate data sharing, reporting, and decision-making across the organization.

4.3 Online Resources and Templates: Access online resources, templates, and tutorials to learn about financial modeling techniques, best practices, and guidelines for creating financial projections. Explore websites, blogs, forums, and online communities dedicated to financial modeling, entrepreneurship, and business planning for valuable insights and resources.

4.4 Industry Reports and Benchmarks: Refer to industry reports, market studies, and financial benchmarks to gather industry-specific data, trends, and benchmarks for use in financial projections. Access industry associations, research firms, government agencies, and trade publications for reliable and up-to-date information on market dynamics and performance metrics.

Conclusion: Creating comprehensive financial projections is essential for businesses to plan, budget, and forecast future financial performance effectively. By following a structured approach, leveraging reliable data and assumptions, and incorporating best practices and tools, businesses can develop accurate, realistic, and actionable financial projections that support strategic decision-making and drive sustainable growth. With careful planning, analysis, and validation, financial projections can serve as a valuable tool for guiding business operations, attracting investors, and achieving long-term success in today’s competitive business environment.