Introduction

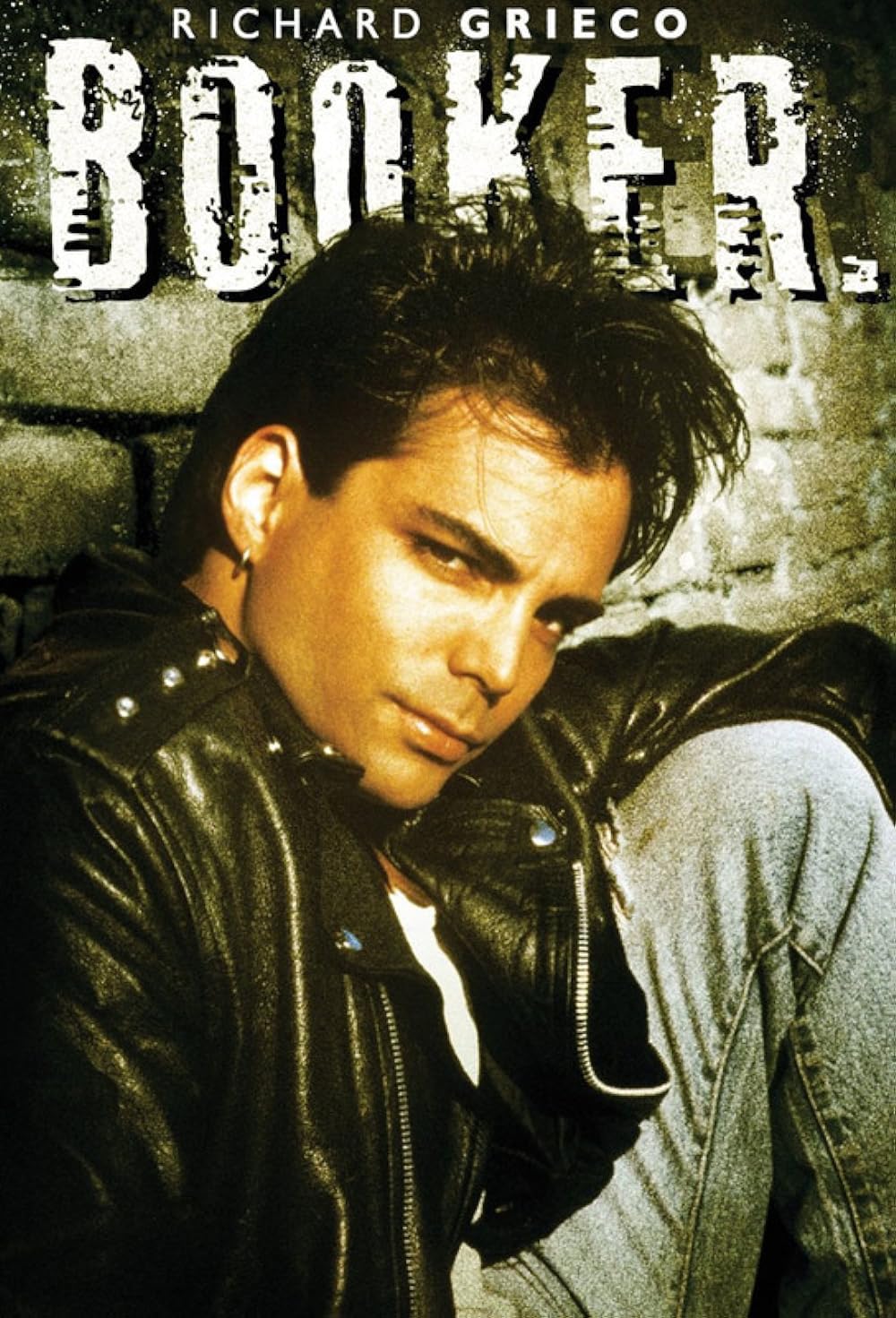

In the late 1980s, the television landscape was ripe with innovative crime dramas, and among them emerged “Booker.” Premiering in 1989 as a spin-off from the popular series “21 Jump Street,” “Booker” took a unique approach to storytelling, centering around the character of Dennis Booker, played by Richard Grieco. Despite its short-lived run, “Booker” carved its niche with a blend of action, drama, and compelling characters. In this extensive exploration, we’ll delve into the origins, characters, impact, and the often-overlooked legacy of “Booker.”

The Genesis of “Booker”

Spin-Off Success

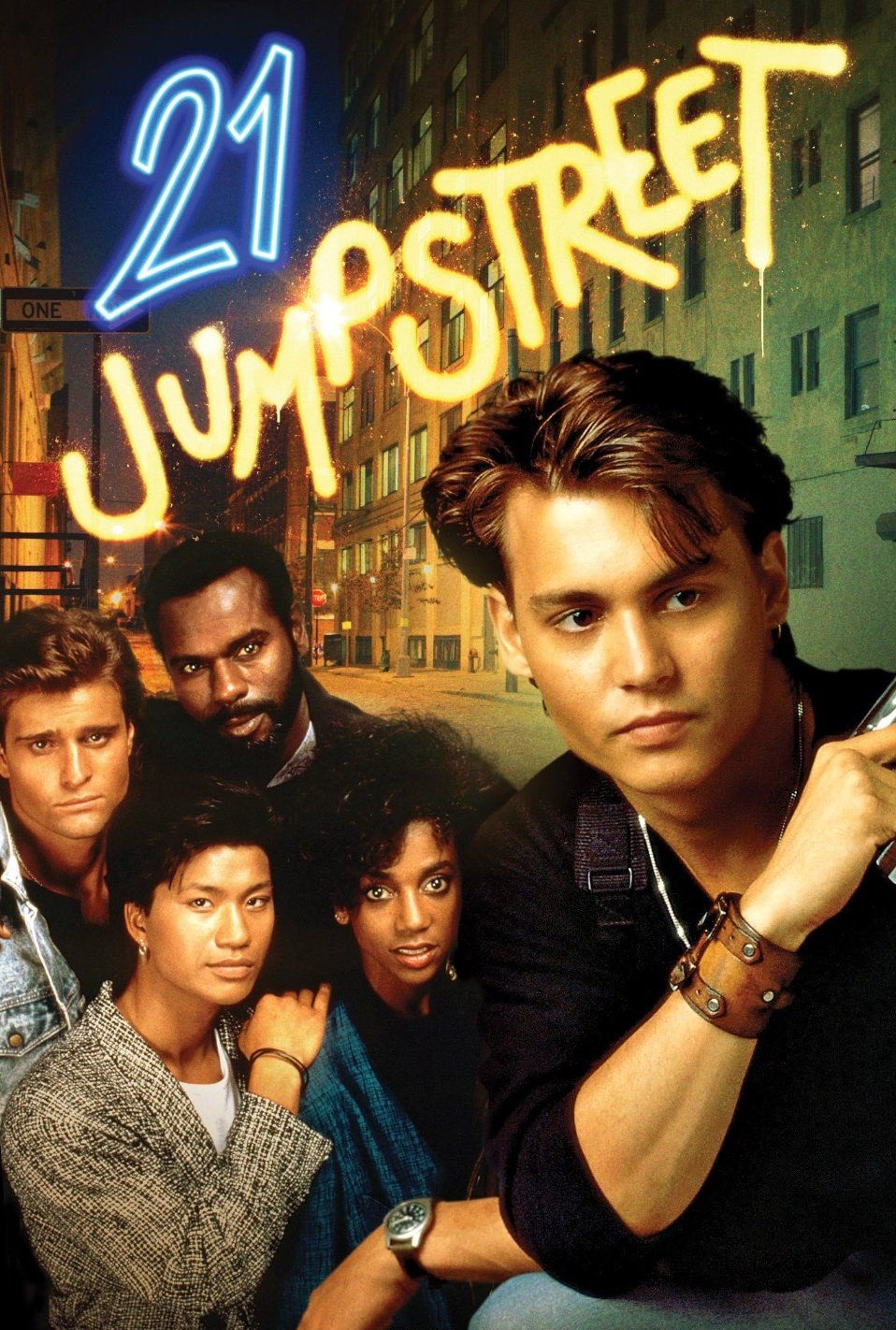

“Booker” was conceived as a spin-off from the critically acclaimed series “21 Jump Street,” sharing the same undercover police procedural universe. The character Dennis Booker, initially introduced in “21 Jump Street,” gained popularity, prompting the decision to explore his solo adventures in a new series.

Dennis Booker: A Complex Protagonist

Dennis Booker, portrayed by Richard Grieco, served as the linchpin for “Booker.” Known for his suave demeanor, street-smart approach, and unconventional methods, Booker was a complex protagonist whose past as an undercover cop provided ample material for compelling storytelling.

The World of “Booker”

Setting and Premise

“Booker” maintained the undercover cop theme of its predecessor but took a different route in terms of setting. Unlike the high school backdrop of “21 Jump Street,” Booker found himself working for the elite “Domestic Security Task Force” under the alias “Dennis Brooks.” This fresh environment allowed for a diverse range of cases, blending action, suspense, and character-driven narratives.

A Multifaceted Protagonist

Dennis Booker’s transition from supporting character to lead protagonist allowed for deeper exploration of his personality. The show delved into Booker’s past, his motivations, and the internal conflicts that shaped his unconventional methods of crime-solving. Grieco’s portrayal added layers to the character, making him more than just a stereotypical cop.

Impact and Reception

Grieco’s Charismatic Performance

Richard Grieco’s portrayal of Dennis Booker received praise for its charisma and distinct style. Grieco brought a certain edge to the character, making Booker stand out in the crowded landscape of television detectives. His unconventional approach to law enforcement resonated with audiences, further solidifying his place in the “Booker” legacy.

Short-Lived Success

Despite positive reception for Grieco’s performance and the show’s intriguing premise, “Booker” faced challenges that led to its premature conclusion after just one season. The show’s brief run left fans yearning for more adventures with Dennis Booker, contributing to its status as a hidden gem in television history.

Characters and Cast

The Ensemble Cast

While Dennis Booker took center stage, “Booker” featured a supporting cast that added depth to the series. The ensemble included characters like Suzanne Dunne (played by Lori Petty), R.J. “Smitty” Smith (played by Carmen Argenziano), and Teal Harper (played by Katie Rich). Each character brought a unique dynamic to the team, contributing to the overall appeal of the show.

Guest Appearances

“Booker” also welcomed guest appearances, adding star power to the series. Notable guests included Johnny Depp, reprising his role as Officer Tom Hanson from “21 Jump Street,” further solidifying the interconnected universe of these undercover crime dramas.

Behind the Scenes

Creative Minds

The development of “Booker” involved collaboration between experienced creators. Stephen J. Cannell, known for his work on “The A-Team” and “Wiseguy,” played a key role in bringing the series to life. The show’s creative minds aimed to maintain the spirit of “21 Jump Street” while crafting a distinctive narrative for Dennis Booker.

Evolution of Dennis Booker

“Booker” provided an opportunity to explore the evolution of Dennis Booker as a character. The shift from a supporting role in “21 Jump Street” to the lead in his own series allowed for a deeper exploration of Booker’s past, motivations, and personal growth.

Legacy and Cult Following

Cult Status

Despite its short run, “Booker” has achieved cult status among television enthusiasts. Fans appreciate the show’s unique blend of action, drama, and character-driven storytelling. Richard Grieco’s portrayal of Dennis Booker remains iconic, and the series holds a special place in the hearts of those who discovered its charms.

Influence on Grieco’s Career

“Booker” played a pivotal role in Richard Grieco’s career, showcasing his talent as an actor. The series helped establish Grieco as a recognizable face in the entertainment industry, opening doors to future projects and cementing his status as a multifaceted performer.

Revisiting “Booker” Today

Nostalgia Factor

For those who experienced “Booker” during its original run, revisiting the series is a nostalgic journey. The show serves as a time capsule of late 1980s television, capturing the essence of the era in its storytelling, fashion, and cultural references.

Hidden Gem for New Audiences

While “Booker” may have been overshadowed by its predecessor, “21 Jump Street,” it remains a hidden gem for new audiences discovering the series. The show’s compact season offers a binge-worthy experience, inviting viewers to immerse themselves in the world of Dennis Booker.

Conclusion

“Booker” (1989–1990) stands as a testament to the creative exploration of crime dramas in the late 1980s. Despite its brief run, the series left an indelible mark on television history, providing a unique perspective on undercover law enforcement through the lens of Dennis Booker. Richard Grieco’s charismatic portrayal, coupled with the show’s intriguing narratives, ensured that “Booker” remains a cherished memory for those who appreciate its distinctive blend of action and character-driven storytelling.

As we delve into the forgotten gem that is “Booker,” it becomes clear that the series holds a special place in the hearts of its dedicated fanbase. From its inception as a spin-off to its evolution into a standalone narrative, “Booker” continues to capture the imagination of audiences, inviting them to revisit the adventures of Dennis Booker and appreciate the legacy of a show that left an indelible mark on the landscape of television crime dramas.