Introduction: Creating an employee handbook is a foundational step in establishing clear expectations, promoting company culture, and ensuring compliance with legal requirements within an organization. An employee handbook serves as a vital resource that outlines policies, procedures, benefits, and expectations for employees. Crafting an effective employee handbook requires thorough planning, careful consideration of company values and culture, and alignment with legal and regulatory standards. In this extensive guide, we will delve into the detailed process of creating an employee handbook, covering essential steps, best practices, and key considerations.

Section 1: Preparing for Handbook Creation 1.1 Define Purpose and Objectives: Before diving into handbook creation, define the purpose and objectives of the handbook. Determine what information needs to be included, the tone of communication, and the desired outcomes, such as enhancing employee understanding, promoting consistency, and mitigating legal risks.

1.2 Establish a Handbook Committee: Form a dedicated team or committee comprising representatives from human resources, legal, management, and relevant departments. This multidisciplinary approach ensures comprehensive coverage of policies, fosters collaboration, and promotes buy-in from key stakeholders.

Section 2: Conducting Research and Gathering Information 2.1 Legal Compliance Review: Conduct a thorough review of federal, state, and local employment laws and regulations relevant to your organization. Ensure that handbook policies comply with laws governing employment practices, anti-discrimination, wage and hour, safety, and other relevant areas to mitigate legal risks.

2.2 Assess Existing Policies and Practices: Review existing policies, procedures, and practices within the organization. Identify areas where policies may need updating, revision, or clarification to align with company values, culture, and current best practices.

Section 3: Outlining and Structuring the Handbook 3.1 Determine Handbook Sections and Topics: Create a comprehensive outline for the handbook, organizing content into logical sections and topics. Common sections include:

- Introduction and Welcome Message

- Company Mission, Vision, and Core Values

- Employment Policies and Practices

- Code of Conduct and Ethics

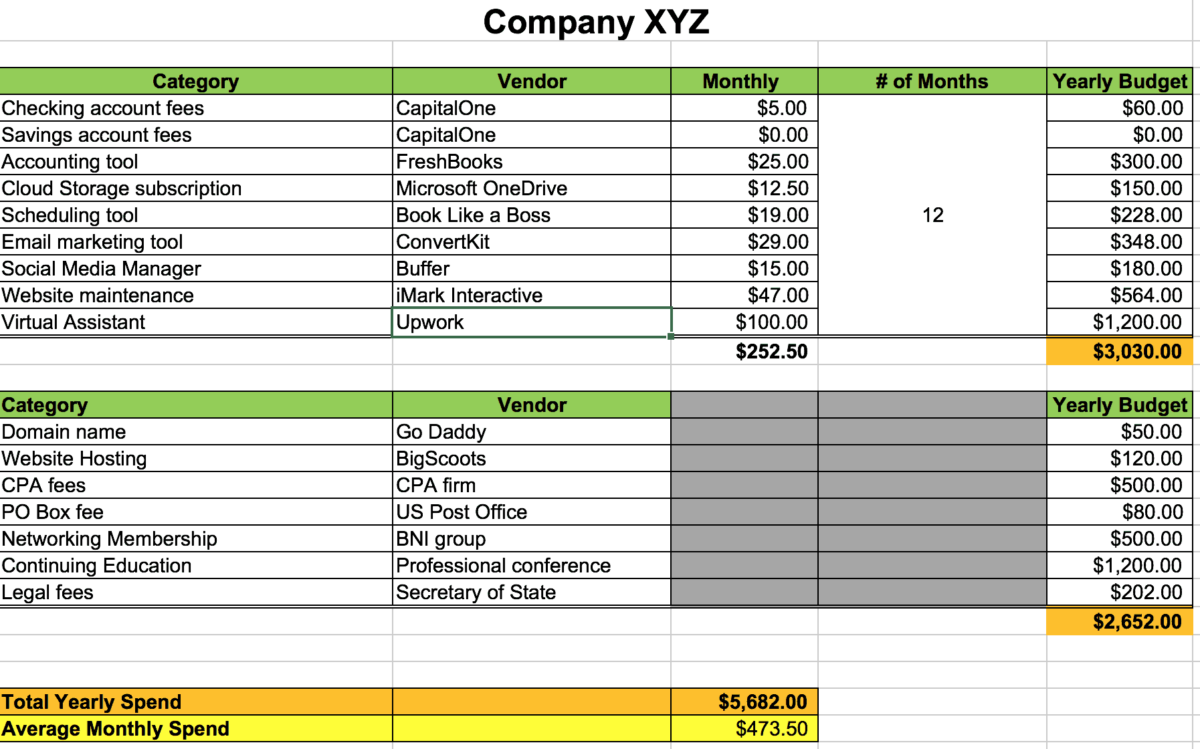

- Compensation and Benefits

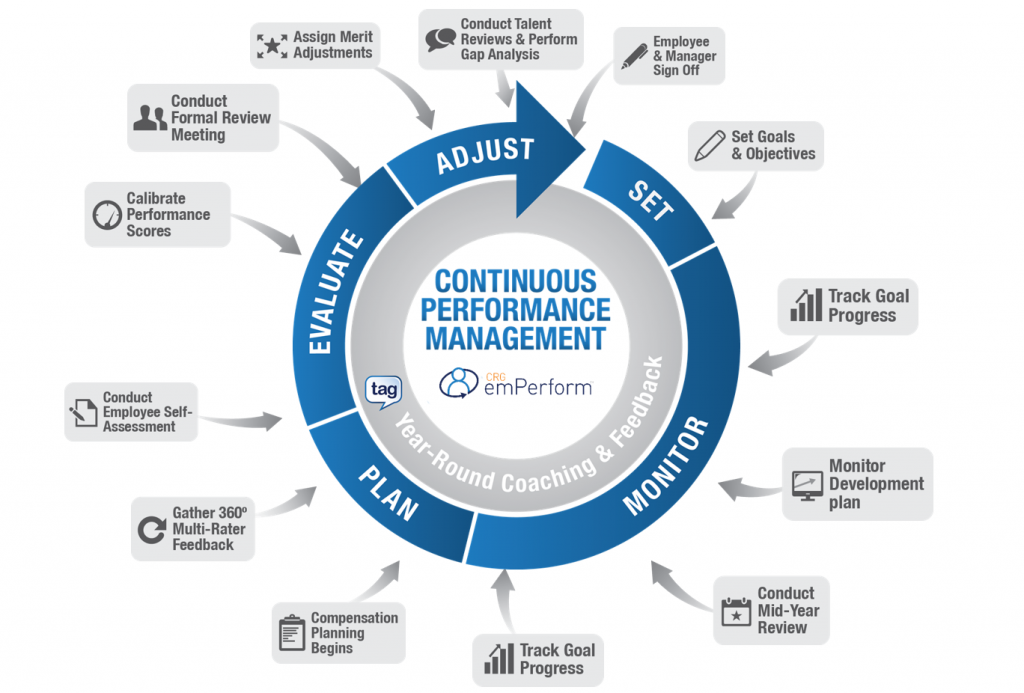

- Performance Management

- Safety and Health Guidelines

- Grievance and Conflict Resolution Procedures

- Acknowledgment and Agreement

3.2 Consider Formatting and Style: Decide on the formatting, style, and design elements of the handbook to ensure readability and engagement. Use clear language, bullet points, headings, and visual elements to enhance comprehension and accessibility. Incorporate branding elements to reinforce company identity and culture.

Section 4: Writing Policies and Procedures 4.1 Drafting Policies: Draft clear, concise, and consistent policies and procedures for each section of the handbook. Use simple language, avoid jargon, and provide examples or scenarios to illustrate key points. Ensure that policies are aligned with company values, legal requirements, and industry standards.

4.2 Include Legal Disclaimers and Notices: Incorporate necessary legal disclaimers, notices, and acknowledgments throughout the handbook. Include statements on at-will employment, non-discrimination, confidentiality, and other legal provisions to protect the organization and inform employees of their rights and obligations.

Section 5: Review and Approval Process 5.1 Legal Review and Compliance Check: Seek legal review and input from qualified legal counsel to ensure that handbook policies comply with applicable laws and regulations. Address any legal concerns, clarify ambiguities, and verify the enforceability of policies to minimize legal risks.

5.2 Stakeholder Feedback and Input: Solicit feedback from key stakeholders, including management, employees, and department heads. Incorporate input and suggestions to ensure that the handbook accurately reflects company culture, values, and operational needs. Gain consensus and approval from leadership before finalizing the handbook.

Section 6: Finalizing and Distributing the Handbook 6.1 Formatting and Design: Finalize the formatting, design, and layout of the handbook to create a professional and visually appealing document. Ensure consistency in formatting, font styles, and graphics throughout the handbook for a cohesive look and feel.

6.2 Distribution and Acknowledgment: Distribute the finalized handbook to all employees through both digital and physical channels. Require employees to review, acknowledge, and sign an acknowledgment form indicating their understanding and acceptance of handbook policies. Maintain records of signed acknowledgments for documentation and compliance purposes.

Section 7: Training and Communication 7.1 Employee Orientation and Training: Conduct comprehensive orientation sessions or training programs to familiarize employees with the contents of the handbook. Cover key policies, procedures, expectations, and company culture to promote understanding and compliance.

7.2 Ongoing Communication: Establish channels for ongoing communication and updates regarding handbook policies and procedures. Encourage open dialogue, address employee questions or concerns, and provide opportunities for clarification or interpretation as needed.

Section 8: Monitoring and Review 8.1 Regular Updates and Revisions: Regularly review and update the handbook to reflect changes in laws, regulations, company policies, or industry standards. Ensure that handbook policies remain current, relevant, and aligned with organizational goals and values.

8.2 Feedback and Evaluation: Solicit feedback from employees regarding their experience with the handbook, including clarity, usability, and effectiveness of policies. Use feedback to identify areas for improvement, address concerns, and enhance the overall quality and usability of the handbook.

Conclusion: Creating an employee handbook is a dynamic and iterative process that requires collaboration, attention to detail, and ongoing commitment to excellence. By following the steps outlined in this guide and leveraging best practices, organizations can develop a comprehensive and effective handbook that serves as a valuable resource for employees and contributes to a positive work environment. A well-crafted handbook not only communicates policies and procedures but also reinforces company values, fosters trust, and promotes alignment with organizational goals, ultimately contributing to employee satisfaction, engagement, and success.