Introduction:

Real estate has long been considered a cornerstone of investment, offering the potential for both stability and attractive returns. In recent years, the landscape of real estate investment has evolved, and one notable phenomenon that has gained prominence is real estate crowdfunding. This innovative approach democratizes real estate investment, allowing individuals to participate in projects that were once the domain of institutional investors. In this comprehensive guide, we will delve into the intricacies of real estate crowdfunding, exploring what it is, how it works, and providing insights for those considering this avenue for investment.

Section 1: Understanding Real Estate Crowdfunding

Subsection 1.1: What is Real Estate Crowdfunding?

Real estate crowdfunding is a method of financing real estate projects by pooling funds from a large number of investors, typically through an online platform. This collective investment allows individuals to become stakeholders in properties ranging from residential developments to commercial real estate, without the traditional barriers to entry associated with direct property ownership.

Subsection 1.2: The Evolution of Real Estate Crowdfunding

The concept of real estate crowdfunding gained momentum in the aftermath of the 2008 financial crisis. As regulations evolved, online platforms emerged to connect investors with real estate developers and operators, creating new opportunities for both parties. Real estate crowdfunding provides a more accessible and diversified approach to property investment compared to traditional methods.

Section 2: How Real Estate Crowdfunding Works

Subsection 2.1: Crowdfunding Platforms

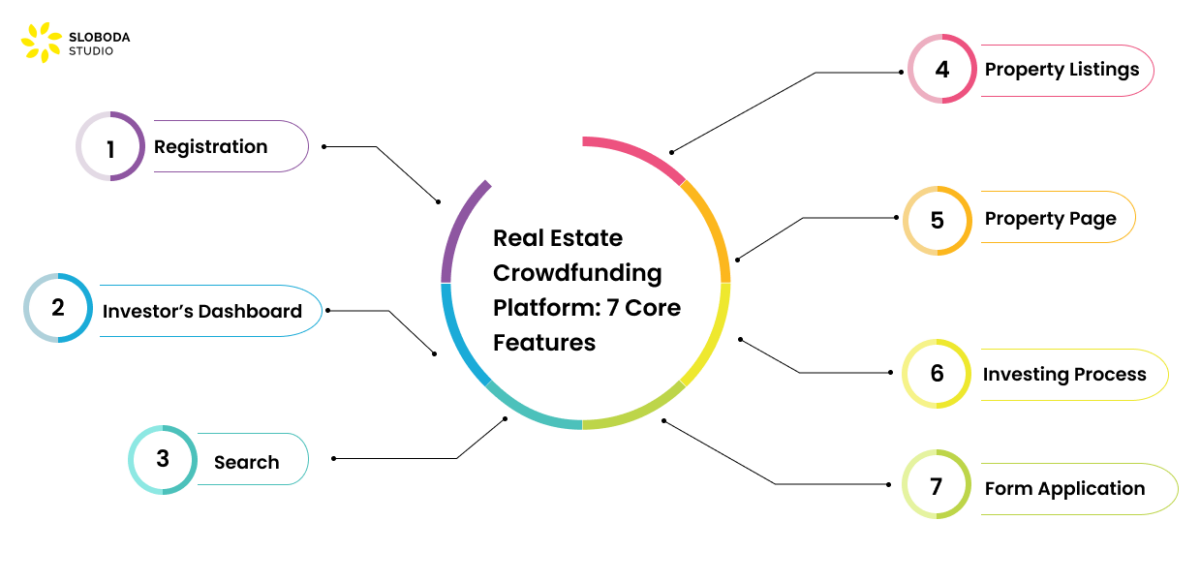

Real estate crowdfunding is facilitated through online platforms that serve as intermediaries connecting investors with real estate opportunities. These platforms vary in their focus, offering projects ranging from residential properties and commercial developments to niche opportunities like hotels or industrial spaces.

Subsection 2.2: Types of Real Estate Crowdfunding

- Equity Crowdfunding: Investors become equity holders in a property or portfolio, sharing in potential profits and losses. Returns are typically generated through property appreciation and rental income.

- Debt Crowdfunding: Investors act as lenders, providing financing for real estate projects. In return, they receive regular interest payments and the return of principal when the loan matures.

- Hybrid Crowdfunding: Combining elements of equity and debt, hybrid crowdfunding models allow investors to participate both as equity holders and lenders. This structure provides a diversified approach to real estate investment.

Section 3: Benefits of Real Estate Crowdfunding

Subsection 3.1: Accessibility and Lower Entry Barriers

Real estate crowdfunding opens the door to property investment for individuals with smaller capital amounts. Investors can participate with relatively modest sums, allowing for diversification across multiple projects.

Subsection 3.2: Diversification Opportunities

Investors can diversify their real estate portfolios by participating in a variety of projects through crowdfunding platforms. This diversification helps mitigate risk by spreading exposure across different property types, locations, and investment structures.

Subsection 3.3: Passive Income and Potential Returns

Real estate crowdfunding offers the potential for passive income and attractive returns. Investors can receive dividends from rental income or interest payments from debt investments. Additionally, they may benefit from property appreciation over time.

Section 4: Risks and Challenges of Real Estate Crowdfunding

Subsection 4.1: Market and Economic Risks

Real estate markets are influenced by economic conditions and market fluctuations. Investors in real estate crowdfunding should be aware of potential downturns, which can impact property values, rental income, and overall returns.

Subsection 4.2: Lack of Liquidity

Unlike publicly traded stocks, real estate crowdfunding investments often lack liquidity. Investors may have limited options for selling their stakes before a project’s completion or exit event, potentially tying up their capital for an extended period.

Subsection 4.3: Project-Specific Risks

Each real estate project comes with its own set of risks, such as construction delays, regulatory challenges, or unexpected expenses. Thorough due diligence on the part of investors and the crowdfunding platform is essential to identify and assess these project-specific risks.

Section 5: How to Invest in Real Estate Crowdfunding

Subsection 5.1: Researching Crowdfunding Platforms

Before investing, conduct thorough research on real estate crowdfunding platforms. Consider factors such as the platform’s track record, the types of projects offered, fees, and the level of transparency provided.

Subsection 5.2: Setting Investment Goals

Define your investment goals and risk tolerance. Determine whether you are seeking income, capital appreciation, or a combination of both. Align your goals with the types of projects offered on crowdfunding platforms.

Subsection 5.3: Due Diligence on Projects

Perform due diligence on individual projects before investing. Review project details, financial projections, the track record of the developer or operator, and any relevant legal or regulatory considerations.

Subsection 5.4: Diversification Strategy

Implement a diversification strategy by spreading your investment across multiple projects or types of real estate. Diversification helps manage risk and enhances the potential for overall portfolio stability.

Section 6: Real Estate Crowdfunding Platforms

Subsection 6.1: Popular Real Estate Crowdfunding Platforms

- Fundrise: Known for its approachable minimum investment requirements and diverse portfolio offerings, Fundrise allows investors to access a range of real estate projects, including eREITs (Real Estate Investment Trusts).

- CrowdStreet: Catering to accredited investors, CrowdStreet provides access to a wide array of commercial real estate opportunities. The platform emphasizes transparency and offers direct investments in individual projects.

- RealtyMogul: With a focus on both debt and equity investments, RealtyMogul provides opportunities for investors of various experience levels. The platform offers access to both residential and commercial real estate projects.

- PeerStreet: Specializing in debt investments, PeerStreet focuses on short-term real estate loans. Investors can participate in loans backed by residential or commercial properties.

Subsection 6.2: Platform-Specific Features

Consider the unique features and offerings of each platform. Some platforms focus on specific property types or investment structures, while others provide a more diversified range of opportunities. Choose a platform that aligns with your investment preferences and goals.

Section 7: Regulatory Considerations

Subsection 7.1: Accredited vs. Non-Accredited Investors

Regulations surrounding real estate crowdfunding often distinguish between accredited and non-accredited investors. Accredited investors typically have higher income or net worth requirements, allowing them access to a broader range of investment opportunities.

Subsection 7.2: Compliance and Reporting

Real estate crowdfunding platforms are subject to regulatory oversight. Ensure that the platform you choose adheres to regulatory standards, provides transparent reporting, and complies with applicable securities laws.

Section 8: Monitoring and Managing Investments

Subsection 8.1: Regular Portfolio Review

Regularly review your real estate crowdfunding portfolio. Monitor project updates, financial performance, and any communications from the crowdfunding platform. Stay informed about developments that may impact your investments.

Subsection 8.2: Reinvestment and Exit Strategies

Consider reinvestment and exit strategies for your real estate crowdfunding investments. Some projects may offer the option to reinvest returns into new opportunities, while others may provide a clear exit plan with potential profit distributions.

Section 9: Case Studies and Success Stories

Subsection 9.1: Successful Real Estate Crowdfunding Stories

Explore case studies and success stories of investors who have achieved positive outcomes through real estate crowdfunding. Understand the strategies they employed, the platforms they chose, and the factors that contributed to their success.

Subsection 9.2: Learning from Challenges

Learn from challenges and setbacks experienced by investors in the real estate crowdfunding space. Understanding both successes and challenges can provide valuable insights for navigating this dynamic investment landscape.

Section 10: The Future of Real Estate Crowdfunding

Subsection 10.1: Technological Advancements

Advancements in technology are likely to shape the future of real estate crowdfunding. Automation, blockchain, and other technological innovations may enhance transparency, efficiency, and accessibility within the industry.

Subsection 10.2: Regulatory Developments

Keep an eye on regulatory developments that may impact the real estate crowdfunding landscape. Evolving regulations can influence the types of projects available, investor eligibility criteria, and overall industry dynamics.

Conclusion:

Real estate crowdfunding represents a transformative shift in the way individuals engage with real estate investments. By understanding the fundamentals, benefits, risks, and practical considerations of real estate crowdfunding, investors can make informed decisions aligned with their financial goals. Whether seeking passive income, diversification, or the potential for attractive returns, real estate crowdfunding offers a dynamic and accessible avenue for participation in the real estate market. May your journey into real estate crowdfunding be characterized by strategic decision-making, successful investments, and the fulfillment of your financial aspirations.