Introduction: Supplier management is a crucial aspect of supply chain management, encompassing the processes and practices involved in selecting, evaluating, and collaborating with suppliers to ensure the timely delivery of high-quality goods and services. A well-developed supplier management strategy is essential for optimizing supplier relationships, mitigating risks, reducing costs, and driving operational excellence. In this extensive guide, we’ll explore the step-by-step process of developing a supplier management strategy, covering everything from supplier selection to performance evaluation, ensuring that you can navigate the complexities of supplier management with confidence and expertise.

Understanding Supplier Management: Supplier management involves the systematic management of relationships with suppliers to achieve strategic business objectives, such as cost reduction, quality improvement, innovation, and risk mitigation. It encompasses a range of activities, including supplier identification, qualification, onboarding, performance monitoring, contract management, and continuous improvement. Effective supplier management requires collaboration, transparency, and alignment of interests between buyers and suppliers to create value and drive mutual success.

Key Principles of Supplier Management: Before diving into the specifics of supplier management, it’s important to understand the key principles that underpin effective supplier management practices:

- Strategic Alignment: Align supplier management activities with the organization’s overall business strategy, goals, and objectives. Ensure that supplier relationships support strategic priorities, such as cost competitiveness, product quality, innovation, and sustainability.

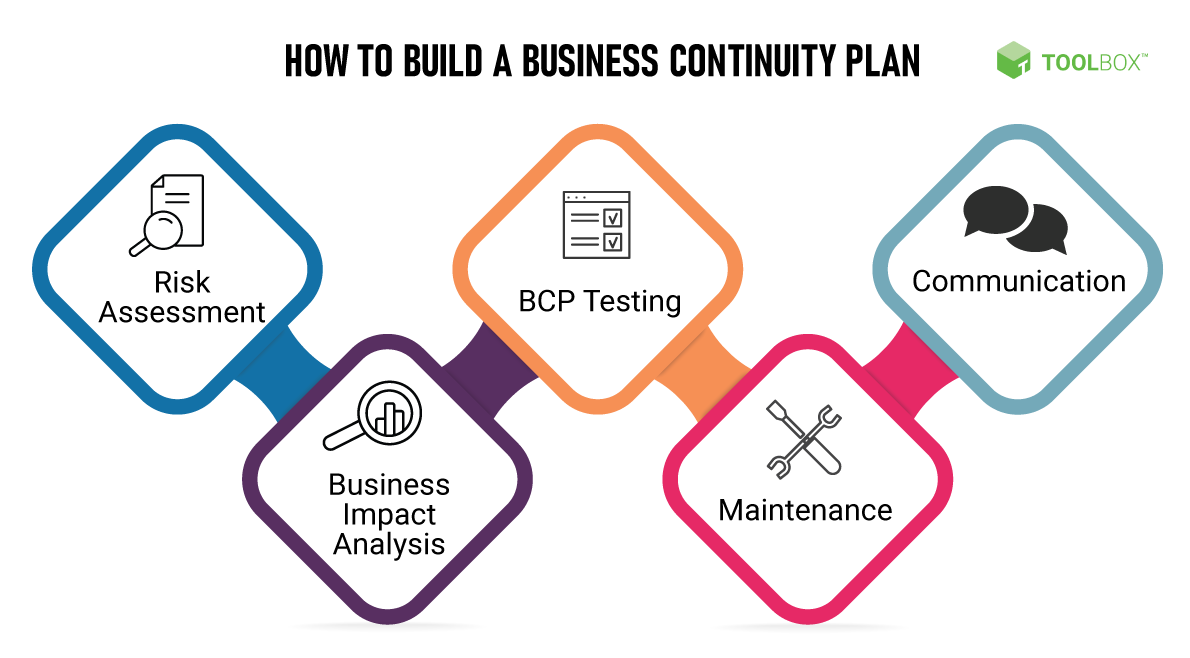

- Risk Management: Identify, assess, and mitigate risks associated with supplier relationships, including supply chain disruptions, quality issues, compliance breaches, and geopolitical risks. Develop risk mitigation strategies and contingency plans to minimize the impact of potential disruptions.

- Performance Measurement: Establish key performance indicators (KPIs) and metrics to measure supplier performance objectively and consistently. Track performance against agreed-upon criteria, such as delivery reliability, quality standards, lead times, and cost savings.

- Collaborative Partnerships: Foster collaborative and mutually beneficial partnerships with key suppliers based on trust, transparency, and shared goals. Engage suppliers as strategic partners in driving innovation, process improvement, and value creation throughout the supply chain.

- Continuous Improvement: Embrace a culture of continuous improvement and learning in supplier management processes. Seek feedback from suppliers, conduct regular performance reviews, and identify opportunities for optimization and innovation.

- Ethical and Responsible Sourcing: Uphold ethical and responsible sourcing practices in supplier relationships, ensuring compliance with labor standards, environmental regulations, and social responsibility principles. Promote sustainability, diversity, and inclusion in the supply chain.

Step-by-Step Guide to Developing a Supplier Management Strategy: Now, let’s delve into the step-by-step process of developing a supplier management strategy:

- Assess Organizational Needs: Start by assessing your organization’s strategic objectives, priorities, and requirements for supplier relationships. Identify the key drivers and criteria for supplier selection, such as cost, quality, reliability, innovation, and sustainability.

- Identify Strategic Suppliers: Identify strategic suppliers who play a critical role in supporting your organization’s operations, product development, and competitive advantage. Evaluate suppliers based on their capabilities, performance, financial stability, and alignment with your strategic objectives.

- Segment Suppliers: Segment suppliers based on their strategic importance, risk profile, and value contribution to your organization. Prioritize resources and efforts based on the strategic significance of each supplier segment.

- Define Supplier Management Processes: Define clear and standardized processes for supplier management, including supplier selection, qualification, onboarding, performance monitoring, relationship management, and contract negotiation. Establish roles, responsibilities, and workflows to ensure accountability and consistency.

- Establish Performance Metrics: Establish performance metrics and KPIs to measure supplier performance across key dimensions, such as quality, delivery, cost, responsiveness, and innovation. Define performance targets and benchmarks to guide supplier evaluations and improvement initiatives.

- Develop Supplier Scorecards: Develop supplier scorecards or dashboards to track and visualize supplier performance data in a structured and actionable format. Use scorecards to communicate performance feedback, identify areas for improvement, and recognize high-performing suppliers.

- Implement Risk Management Strategies: Implement risk management strategies to identify, assess, and mitigate risks associated with supplier relationships. Conduct risk assessments, establish risk mitigation plans, and monitor risk indicators to proactively address potential disruptions.

- Enhance Collaboration and Communication: Foster open, transparent, and collaborative communication channels with suppliers. Establish regular meetings, performance reviews, and joint improvement initiatives to align goals, address issues, and drive continuous improvement.

- Negotiate Supplier Contracts: Negotiate supplier contracts and agreements that clearly define expectations, deliverables, responsibilities, and performance metrics. Ensure that contracts incorporate provisions for quality assurance, service levels, pricing, payment terms, and dispute resolution mechanisms.

- Monitor and Evaluate Supplier Performance: Continuously monitor and evaluate supplier performance against established criteria and benchmarks. Conduct regular performance reviews, supplier audits, and site visits to assess compliance, identify opportunities for improvement, and address performance gaps.

Advanced Strategies for Supplier Management Success: To elevate your supplier management efforts and achieve superior outcomes, consider implementing the following advanced strategies:

- Supplier Development Programs: Implement supplier development programs to enhance the capabilities, processes, and performance of key suppliers. Provide training, resources, and support to help suppliers improve their operations, quality standards, and competitiveness.

- Supplier Collaboration Platforms: Invest in supplier collaboration platforms and technologies to streamline communication, collaboration, and information sharing with suppliers. Use cloud-based platforms, supplier portals, and digital tools to facilitate real-time collaboration and data exchange.

- Supplier Relationship Management (SRM) Systems: Deploy supplier relationship management (SRM) systems to centralize and automate supplier management processes. Use SRM systems to track supplier interactions, manage contracts, monitor performance, and generate insights for decision-making.

- Supplier Diversity and Inclusion Initiatives: Promote supplier diversity and inclusion by sourcing from a diverse range of suppliers, including minority-owned, women-owned, veteran-owned, and small businesses. Establish supplier diversity programs and set targets for diverse supplier participation.

- Supplier Innovation Programs: Encourage supplier innovation and collaboration by soliciting ideas, feedback, and suggestions from suppliers. Create innovation forums, workshops, and co-development programs to foster creativity, problem-solving, and value creation.

- Supplier Sustainability Initiatives: Incorporate sustainability criteria into supplier selection, evaluation, and performance management processes. Collaborate with suppliers to improve environmental performance, reduce carbon footprint, and promote sustainable practices throughout the supply chain.

- Supplier Community Building: Build a strong and engaged supplier community by fostering relationships, networking opportunities, and knowledge sharing among suppliers. Organize supplier events, conferences, and forums to facilitate collaboration and best practice sharing.

- Supplier Risk Intelligence: Leverage supplier risk intelligence platforms and services to proactively monitor and assess supplier risks. Use data analytics, predictive modeling, and scenario analysis to identify emerging risks and vulnerabilities in the supply chain.

Practical Applications and Case Studies: Supplier management strategies are applicable across various industries and sectors, enabling organizations to optimize supplier relationships and drive business success. Here are some practical applications and case studies that illustrate the importance and impact of supplier management:

- Automotive Industry: Automotive manufacturers rely on effective supplier management strategies to ensure the quality, reliability, and competitiveness of their supply chains. Companies like Toyota have implemented rigorous supplier quality management systems to maintain high standards and minimize defects in automotive components.

- Retail Sector: Retailers leverage supplier management strategies to streamline sourcing, inventory management, and product assortment planning. Retail giants like Walmart work closely with suppliers to optimize product availability, pricing, and merchandising strategies to meet customer demand.

- Pharmaceuticals and Healthcare: Pharmaceutical companies prioritize supplier quality and compliance to ensure the safety, efficacy, and regulatory compliance of pharmaceutical products. Companies like Johnson & Johnson have robust supplier management programs to monitor supplier performance, mitigate risks, and maintain product integrity.

- Technology Sector: Technology companies rely on strategic supplier relationships to drive innovation, reduce time-to-market, and maintain competitive advantage. Companies like Apple collaborate with suppliers to develop cutting-edge technologies, improve product design, and optimize supply chain efficiency.

- Food and Beverage Industry: Food and beverage companies implement supplier management strategies to ensure food safety, quality, and traceability throughout the supply chain. Companies like Nestlé have supplier quality assurance programs to monitor ingredient sourcing, production processes, and product safety standards.

Conclusion: Developing a comprehensive supplier management strategy is essential for optimizing supplier relationships, mitigating risks, and driving business success in today’s global marketplace. By following a systematic approach, embracing key principles, and implementing advanced strategies, organizations can effectively manage supplier relationships, enhance supply chain resilience, and achieve competitive advantage. Whether you’re a manufacturer, retailer, healthcare provider, or technology company, investing in supplier management capabilities is critical for ensuring product quality, reliability, and sustainability. So, embrace the challenge of supplier management, cultivate strategic partnerships with suppliers, and embark on a journey of supply chain excellence and innovation.