Introduction:

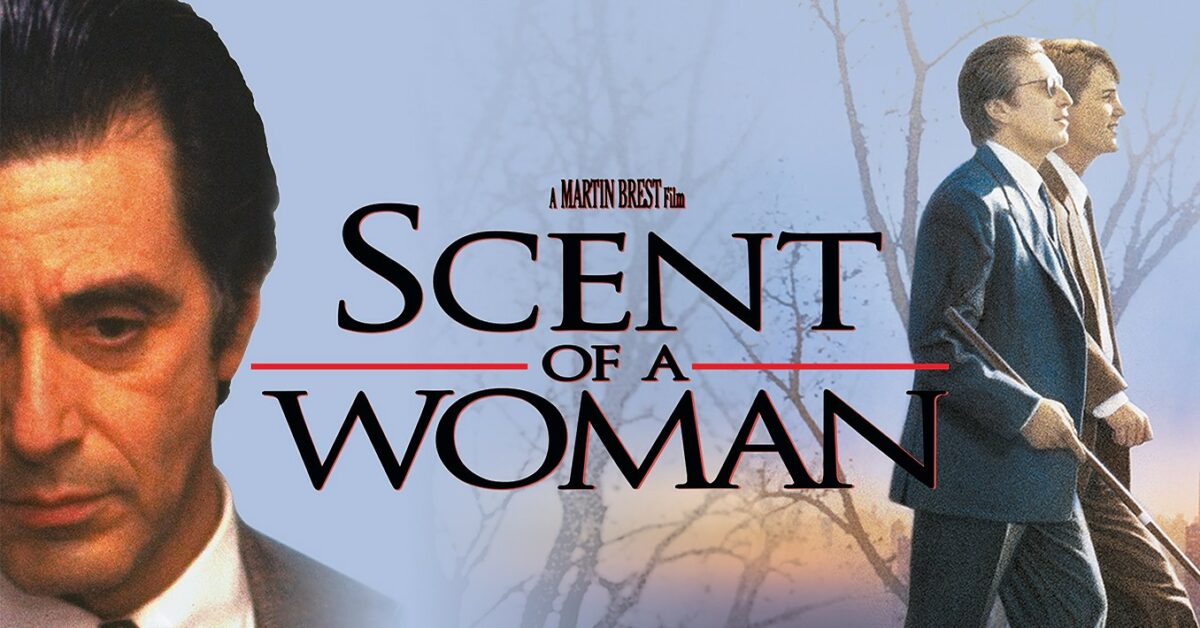

Released in 1992 and directed by Martin Brest, “Scent of a Woman” is a compelling thriller and drama that navigates the complexities of human character, redemption, and the pursuit of self-discovery. Anchored by the powerhouse performance of Al Pacino, the film weaves a narrative that delves into the shadows of a damaged soul and the transformative power of an unexpected friendship. Join us on a comprehensive exploration of “Scent of a Woman,” dissecting its themes, characters, and the nuanced dance between darkness and redemption.

I. Plot Overview:

“Scent of a Woman” unfolds as a character-driven drama centered around Charlie Simms (Chris O’Donnell), a student who takes a temporary job over Thanksgiving weekend to care for the blind and irascible retired Army Colonel Frank Slade (Al Pacino). As the weekend progresses, secrets are unveiled, friendships are forged, and both characters embark on a journey of self-discovery.

A. Character Dynamics:

- Explore the dynamic between Charlie Simms and Colonel Frank Slade.

- Analyze how their relationship evolves over the course of the film, transcending initial assumptions and stereotypes.

B. Themes of Redemption and Identity:

- Delve into the overarching themes of redemption and the search for identity.

- Discuss how the characters grapple with their pasts and strive for personal redemption and self-acceptance.

II. Cast and Performances:

A. Al Pacino as Colonel Frank Slade:

- Assess Al Pacino’s iconic portrayal of the complex and enigmatic Colonel Frank Slade.

- Explore Pacino’s performance, delving into the nuances of a character dealing with inner demons, regret, and the pursuit of life’s pleasures.

B. Chris O’Donnell as Charlie Simms:

- Analyze Chris O’Donnell’s performance as the young and impressionable Charlie Simms.

- Discuss O’Donnell’s ability to convey Charlie’s internal conflicts and moral dilemmas throughout the film.

C. Supporting Cast:

- Evaluate the contributions of the supporting cast, including James Rebhorn, Gabrielle Anwar, and Philip Seymour Hoffman.

- Discuss how the ensemble cast enhances the narrative and contributes to the emotional resonance of the film.

III. Directorial Choices:

A. Martin Brest’s Direction:

- Assess Martin Brest’s directorial choices in shaping the tone and pacing of “Scent of a Woman.”

- Discuss Brest’s ability to balance drama, humor, and intensity while exploring the internal and external conflicts of the characters.

B. Cinematography and Visual Style:

- Delve into the cinematography, examining how visuals are used to convey emotions and the character’s perspectives.

- Analyze the film’s visual style, including its use of color, lighting, and framing to enhance the storytelling.

C. Score and Soundtrack:

- Examine the impact of Thomas Newman’s score on the film’s emotional beats.

- Discuss how the soundtrack complements the narrative, contributing to the overall atmosphere and mood.

IV. Exploration of Morality and Consequences:

A. Moral Dilemmas and Choices:

- Explore the moral dilemmas faced by the characters, particularly Colonel Slade and Charlie.

- Discuss the consequences of their choices and how they shape the trajectory of the narrative.

B. The Complexity of Human Morality:

- Analyze how the film navigates the complexity of human morality, challenging conventional notions of right and wrong.

- Discuss the exploration of moral gray areas and the characters’ struggles with societal expectations.

V. Redemption and Acceptance:

A. Colonel Slade’s Journey:

- Delve into Colonel Slade’s journey towards redemption and self-acceptance.

- Discuss the pivotal moments that mark his transformation and the impact of Charlie’s influence on his outlook.

B. Charlie’s Coming-of-Age:

- Explore Charlie’s coming-of-age story and the lessons he learns from his time with Colonel Slade.

- Discuss how the film portrays Charlie’s growth and maturity as he confronts the challenges presented by his relationship with the Colonel.

VI. Criticisms and Controversies:

A. Reception and Criticisms:

- Examine the critical reception of “Scent of a Woman” upon its release.

- Discuss any criticisms or controversies surrounding the film, including its portrayal of disability and the ethics of certain character choices.

VII. Awards and Recognition:

A. Academy Awards:

- Explore the film’s journey through the awards season, including nominations and wins.

- Discuss the recognition received by Al Pacino for his performance and the overall impact of the film on the awards circuit.

VIII. Legacy and Cultural Impact:

A. Enduring Legacy:

- Reflect on the enduring legacy of “Scent of a Woman” in the realm of character-driven dramas.

- Discuss how the film’s exploration of redemption, morality, and the complexity of human relationships continues to resonate with audiences.

B. Pacino’s Iconic Performance:

- Analyze Al Pacino’s portrayal of Colonel Slade as an iconic and memorable performance in his illustrious career.

- Discuss how Pacino’s depiction of the character has become a touchstone in cinematic history.

IX. Conclusion:

In conclusion, “Scent of a Woman” (1992) stands as a riveting exploration of the human condition, morality, and the transformative power of unexpected connections. Al Pacino’s magnetic performance, coupled with the film’s nuanced storytelling and character development, elevates it to a timeless classic that continues to captivate audiences. As we immerse ourselves in the dance between darkness and redemption within the narrative, we find a poignant and resonant tale that transcends its time, leaving an indelible mark on the landscape of dramatic cinema. “Scent of a Woman” invites viewers to reflect on the complexities of human nature and the enduring possibilities for redemption and self-discovery even in the face of life’s challenges.