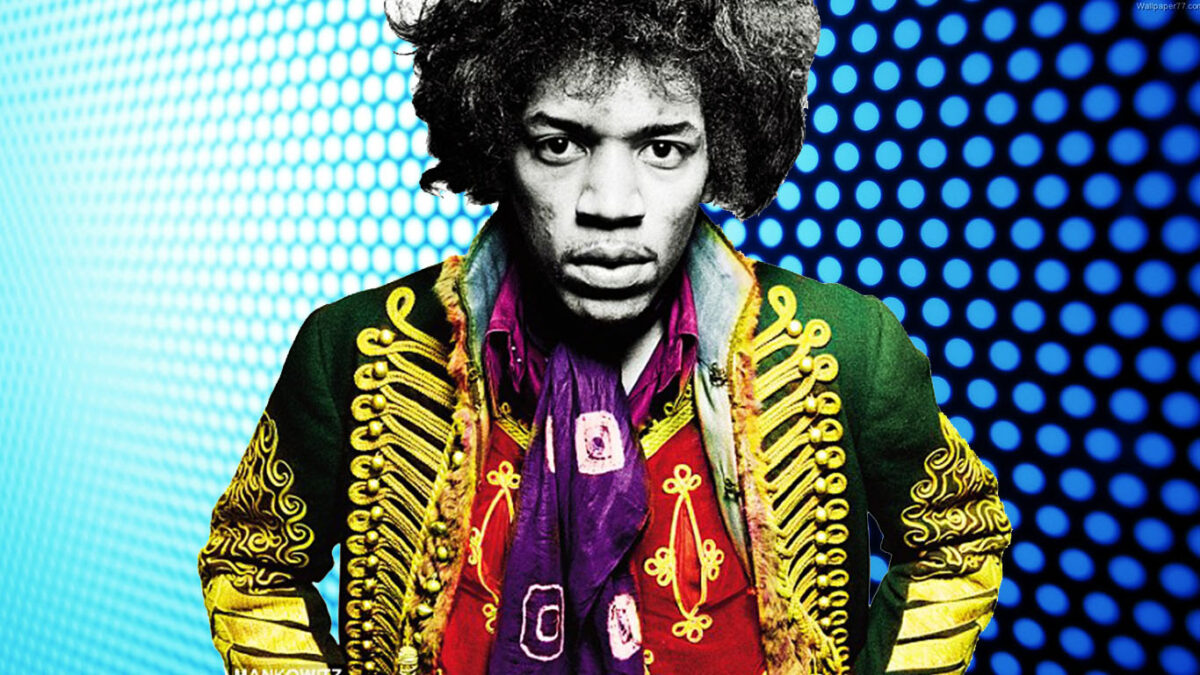

Jimi Hendrix, born Johnny Allen Hendrix on November 27, 1942, in Seattle, Washington, is widely regarded as one of the most influential and innovative guitarists in the history of rock music. With his virtuosic playing, groundbreaking techniques, and pioneering approach to songwriting, Hendrix revolutionized the electric guitar and left an indelible mark on the landscape of popular music. In this extensive exploration, we’ll delve deep into the life, music, and legacy of the legendary guitarist, unraveling the mysteries behind the man and his music.

Early Years and Musical Influences

Jimi Hendrix’s journey into the world of music began at an early age, as he was introduced to the guitar by his father, who nurtured his son’s budding talent and encouraged his passion for music. Inspired by blues and R&B artists such as Muddy Waters, B.B. King, and Chuck Berry, Hendrix honed his skills as a guitarist and began performing in local clubs and venues around Seattle.

The Rise to Fame: Hendrix’s Breakthrough

It was not long before Jimi Hendrix caught the attention of music industry insiders with his electrifying performances and innovative playing style. In 1966, Hendrix moved to London, where he formed the Jimi Hendrix Experience with bassist Noel Redding and drummer Mitch Mitchell. The band quickly gained a following with their explosive live shows and Hendrix’s mesmerizing guitar work.

Electric Ladyland: Hendrix’s Magnum Opus

In 1968, Jimi Hendrix released “Electric Ladyland,” widely considered his magnum opus and one of the greatest rock albums of all time. The album showcased Hendrix’s unparalleled guitar virtuosity and experimental approach to music, featuring iconic tracks such as “Voodoo Child (Slight Return),” “All Along the Watchtower,” and “Crosstown Traffic.” “Electric Ladyland” solidified Hendrix’s status as a musical innovator and cemented his legacy as a guitar legend.

Woodstock and Beyond: Hendrix’s Iconic Performances

One of the defining moments of Jimi Hendrix’s career came in 1969 when he headlined the Woodstock Music & Art Fair, delivering a legendary performance that has since become the stuff of rock ‘n’ roll legend. Hendrix’s rendition of “The Star-Spangled Banner,” featuring his groundbreaking use of guitar feedback and distortion, captured the spirit of the era and remains one of the most iconic moments in rock history.

Hendrix’s Influence and Legacy

Jimi Hendrix’s influence extends far beyond his brief but prolific career, shaping the course of rock music and inspiring generations of musicians to come. His innovative guitar techniques, including his use of feedback, distortion, and wah-wah pedal, paved the way for countless guitarists to explore new sonic possibilities and push the boundaries of the instrument.

The Tragic End: Hendrix’s Untimely Death

Despite his meteoric rise to fame, Jimi Hendrix’s life was tragically cut short on September 18, 1970, when he died of asphyxiation due to a drug overdose at the age of 27. Hendrix’s untimely death robbed the world of one of its most gifted and visionary musicians, leaving behind a legacy that continues to resonate with audiences around the globe.

Honors and Recognition

In the years since his passing, Jimi Hendrix has been posthumously honored with numerous awards and accolades, including induction into the Rock and Roll Hall of Fame in 1992 and a Grammy Lifetime Achievement Award in 1993. His music remains as relevant and influential today as it was during his lifetime, with new generations of fans discovering and appreciating his groundbreaking work.

Conclusion

In conclusion, Jimi Hendrix stands as a towering figure in the annals of rock music, a guitar virtuoso whose innovative playing and visionary approach to music continue to inspire and captivate audiences around the world. From his electrifying performances to his groundbreaking recordings, Hendrix pushed the boundaries of what was possible with the electric guitar, leaving an indelible mark on the landscape of popular music. Though his life was tragically cut short, Hendrix’s legacy lives on through his timeless music, which remains as vibrant and influential today as it was during his lifetime. As we reflect on the life and music of Jimi Hendrix, we are reminded of the transformative power of art to transcend boundaries, unite communities, and inspire generations to come. Hendrix may have left this world too soon, but his spirit lives on in the enduring brilliance of his music, which continues to inspire and uplift listeners around the globe.